What is an Itemized Invoice?

An itemized invoice lists each product or service with its cost, instead of a single total. For example, a plumbing bill may show pipe replacement ($60), labor ($90), and an emergency fee ($50), for a total of $200. This clear breakdown helps customers see exactly what they are paying for and builds trust.

What is an Itemized Bill and Why Do You Need It?

An itemized bill is essentially another form of an itemized invoice, offering the same level of detail. According to Stripe, itemized bills:

- Build transparency and credibility

- Reduce disputes and delays

- Display the value of delivered services

- Improve record-keeping

- Allow flexibility in presenting charges

- Aid in meeting industry-specific requirements.

These benefits help both customers and businesses avoid misunderstandings and streamline financial operations.

Itemized Bill vs. Itemized Invoice

While the terms often overlap, here’s a subtle distinction:

- Itemized Bill: Frequently used in healthcare, hospitality, and utilities, focusing on what was charged.

- Itemized Invoice: Common in business-to-business transactions and professional services. It serves as both a detailed bill and a formal payment request.

Where Are Itemized Invoices Used?

Itemized invoices are widely used by companies that provide services, on-site operations, or multi-component products, because they need transparency in costs, easier dispute resolution, and detailed tracking for both clients and internal accounting.

For example:

- Home Services: Electricians, plumbers, and HVAC technicians list labor, spare parts, and call-out charges separately so customers see exactly what they are paying for.

- Field Audits: Brands and agencies charge per store visit, compliance check, or reporting task, ensuring retailers understand each service delivered.

- Merchandising: Costs are broken down into shelf checks, replenishments, and reporting, which helps CPG brands monitor efficiency and spending.

- Field Sales: Companies invoice per visit, order entry, commissions, and travel costs, making expense control and performance measurement more accurate.

- Facility Management & Cleaning: Tasks, time spent, and materials used are itemized, giving building managers clear visibility into service value.

- IT & Maintenance Services: Support hours, licenses, and hardware replacements are billed separately, helping businesses manage budgets and justify costs.

By itemizing invoices, businesses across these industries create clarity and trust, while clients gain a transparent view of where their money goes.

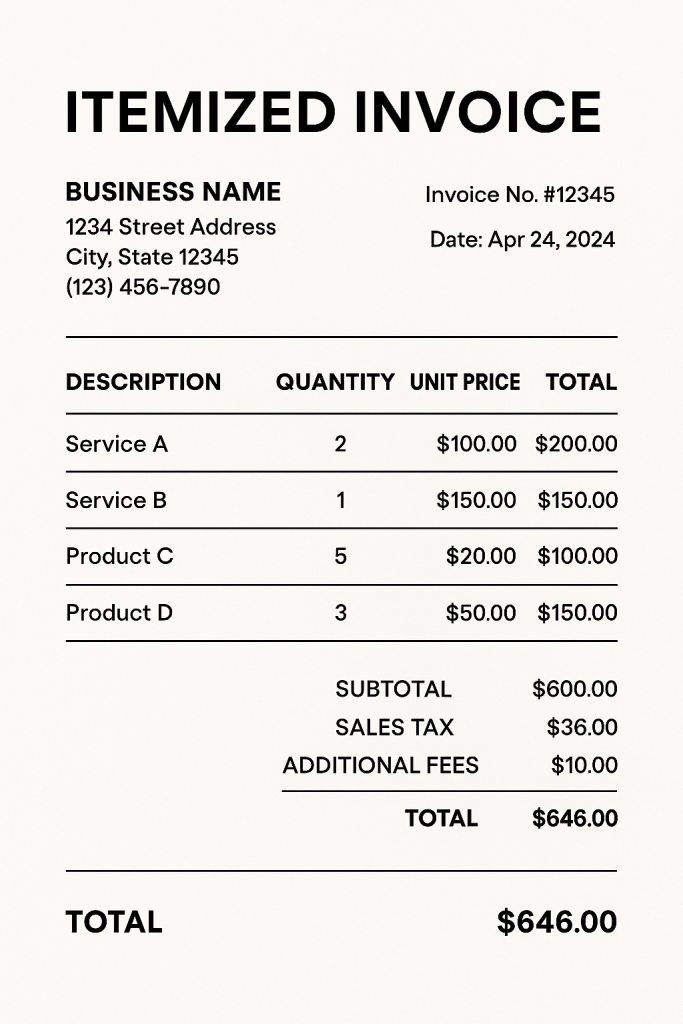

What Should an Itemized Invoice Include?

- Your business identity (name, logo, address, contact) and the customer’s details.

- Invoice number, issue date, and due date/terms (e.g., Net-14 for home services call-outs).

- Line items: clear description, date of service, quantity/units (hours, visits, SKUs), unit price, line total.

- Adjustments: discounts, credits, surcharges (e.g., “eco-cleaning products surcharge”), taxes, subtotal, grand total.

- Payment instructions: bank details or instant pay link; notes (e.g., warranty, service window).

How Do I Send an Itemized Invoice?

Step by Step

- Generate the invoice in your tool (e.g., Stripe/QuickBooks/Field service app).

- Attach proofs where relevant (before/after photos for home services; audit photos; signed work orders).

- Deliver via email and a secure link/SMS if your tool supports it (multiple channels = fewer “I didn’t see it” excuses).

- Automate reminders (e.g., T-3, Due Day, +3, +7).

- Track opens & payments, resend with a one-click pay link.

Sector-specific sending tips

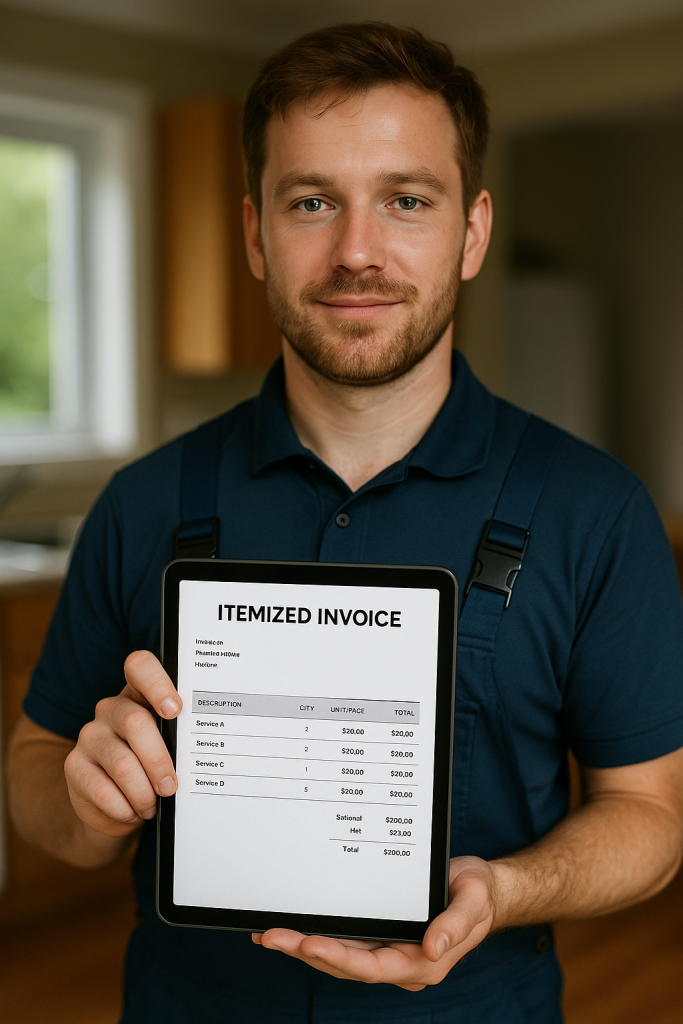

- Home Services: Send on-site from mobile (customer signs on glass), attach geo-stamped, time-stamped photos, and include a “Pay now” link for same-day closeout.

- Field Audit: Embed audit IDs, store IDs, and time windows in line items; attach compliance photos so accounts-payable can approve without going back to ops.

- Merchandising: Include PO/SKU references and promo codes; attach shelf photos to prove execution, which speeds buyer approval.

How to Create Effective Itemized Invoices

1) Standardize Templates

Use consistent naming (e.g., “Service – Location – Unit”) and avoid vague labels (“labor,” “misc.”). Short, specific lines resolve questions before they become disputes.

2) Mirror How the Work is Done

If your techs work in tasks (diagnostics → part replacement → test), invoice in that sequence so approvers can follow the story.

3) Embed Compliance up Front

If you sell into regions with mandates, ensure your output meets structured e-invoice requirements (where applicable).

- In the EU, public administrations must accept e-invoices conforming to the European standard (EN 16931) under Directive 2014/55/EU—aligning formats reduces rejections and accelerates payment. (European Commission, eInvoicing – eInvoicing Directive 2014/55/EU)

- E-invoicing mandates keep expanding—by 2025, new requirements now cover nonresidents’ VAT reporting in several markets—so template discipline pays off.” (The Tax Adviser, Global Expansion of E-Invoicing and Digital Reporting Obligations for Nonresidents)

4) Add Instant Payment Rails

Card/ACH links on the invoice page convert faster than “please wire.” With late payments elevated in both the US and UK in 2025, fewer clicks = faster cash.

5) Automate the Boring Parts

- Route recurring fees (e.g., “filter plan – monthly”) and standard call-outs as pre-built line items.

- Let your AP/AR tooling handle reminders and reconciliation. In 2025, AP teams spending fewer than 10 hours per week on invoices rose to 52%, reflecting efficiency wins from automation.

6) Attach Evidence Where It Matters

- Home Services: time-stamped before/after photos + signed work authorization.

- Field Audit: checklist export + photo set + GPS tag → eliminated back-and-forth for buyer teams.

- Merchandising: planogram reference + aisle/fixture ID + photo proof → fewer deductions.

Benefits of Itemized Invoices for Businesses and Clients

For Businesses

- Fewer disputes, improved cash flow: One freelancer reduced their dispute rate by 80% after switching to itemized invoicing—clients understood charges clearly and paid faster. (Source: SolidGigs, 2025)

- Sharper AP efficiency: In 2025, ~39% of all invoices still contained errors when processed manually. Automating itemized invoicing (OCR, AI) reduced human errors by up to 40%. (Sources: DocuClipper, 2025; ResolvePay, 2025)

- Reduced dilution in invoice financing: Companies tracking dispute patterns saw 20% fewer cash-flow surprises by improving documentation and clarity in invoices. (Source: ResolvePay, 2025)

For Clients / Customers

- Transparency builds trust: When clients see exactly what they’re paying for (e.g., hours, materials, tasks), satisfaction increases. Anecdotally, businesses cited faster approvals and fewer calls. (Source: SolidGigs, 2025)

- Better budgeting & reimbursement: Especially in home services (e.g., HVAC warranties) and retail (client-approved merchandising), clients can itemize line items for expense claims or budgeting.

Common Itemized Invoice Mistakes to Avoid

- Missing or inaccurate line details: In 2025, 39% of invoices processed manually had errors. Vague labels like “service” instead of “Kitchen Deep Clean – 2 hrs – $60” cause confusion and delays. (Source: DocuClipper, 2025)

- Incorrect labor hours or consumables: CPRS audit reports from 2025 highlight top billing errors, including incorrect labor hours and mis-billed small tools or consumables—one client was overcharged $474,000. (Source: CPRS, 2025)

- Invoicing too late or to the wrong recipient: Many small businesses delay invoicing. Late invoices and wrong recipients are among the top mistakes, leading to delayed payments or lost revenue. (Source: Conta.com, 2025)

Measuring the Success of Your Itemized Invoicing

Track these KPIs:

- Dispute rate – ideally trending downward.

- Average time to payment – target a reduction.

- Error rate on invoices sent.

- Time your team spends resolving billing issues.

Automation Cuts Time, Errors, and Costs

Manual processes in 2025 still take ~14.6 days per invoice and cost ~$15 each. Teams with more automation spend less than 1 hour/week on invoice admin; 56% spend more than 10 hours. (Source: DocuClipper, 2025)

Outcome: Reducing errors, speeding dispute resolution, and improving templates—all with itemized billing—directly impacts these metrics and boosts profitability.

Conclusion

Itemized invoices bring clarity, trust, and faster payments—and in 2025, they’re a true game-changer. With FieldPie, the field management software, you can create detailed invoices in seconds, add proof, and get paid faster. Book your free demo today.